Attendees of the recent 2019 Annual Washington Update – Bringing Washington to Boston received a wealth of information and insights from a great line-up of speakers.

Attendees of the recent 2019 Annual Washington Update – Bringing Washington to Boston received a wealth of information and insights from a great line-up of speakers.

Rachel Leiser Levy, Healthcare Tax and Policy Principal at Groom Law Group, kicked off the program with a comprehensive update on the ever-evolving landscape of health reimbursement arrangements (“HRAs”). After a fascinating review of the history of HRAs post-health care reform, Levy provided an excellent overview of the critical provisions in the June, 2019 tri-agency final regulations, published in response to President Trump’s Executive Order 13813 (“Promoting Healthcare Choice and Competition Across the United States”). The regulations address Individual Choice HRAs – or ICHRAs – and Excepted Benefit HRAs – or EBHRAs.

After adoption of the Affordable Care Act (“ACA”), the use of HRAs to pay for individual health insurance was largely curtailed, primarily in response to concerns that if HRAs could be used to provide tax-advantaged benefits for employees who obtain individual coverage through “marketplaces” (or “exchanges”), the marketplaces could be undermined by employers “dumping” higher-risk groups out of employer-sponsored group health plans. Employers, who had been using HRAs to subsidize individual coverage, which in some cases, was less expensive or provided better benefits, pushed back. ICHRAs and EBHRAs are the result.

ICHRAs allow for the reimbursement of premiums for individual coverage (including Medicare), provided certain enrollment, opt-out, nondiscrimination, notice and substantiation requirements are met. EBHRAs do not generally allow for the reimbursement of premiums for individual coverage but do allow for the reimbursement of premiums for so-called excepted benefits, such as limited scope dental and vision, long-term care, short-term limited duration insurance (“STLDI”) and COBRA. ICHRAs can be offered to certain specified “classes” of employees and there is no cap on the dollar amount that can be reimbursed, but if an ICHRA is offered to an employee, group health plan coverage cannot be available. In contrast, EBHRAs allow reimbursement of only a limited amount ($1,800 per year, indexed annually for inflation) and group health plan coverage must be offered by the employer; an EBHRA must also be made available to all “similarly situated employees,” an attempt to limit concerns of adverse selection by sponsors steering participants with adverse health factors away from group health plan coverage.

Although ICHRAs and EBHRAs provide employers some additional flexibility in terms of health benefits, particularly for employers in industries with relatively low-paid workers, Levy noted that it remains to be seen what the up-take will be for these arrangements. The regulations are effective January 1, 2020.

Veena Murthy, Legislation Counsel for the Congressional Joint Committee on Taxation, next spoke about current legislative proposals, most notably the SECURE Act, which passed the House last May and is under consideration by the Senate. (A “blue book” relating to the SECURE Act is available here.) Among the most significant legislative proposals involving retirement plans (in the SECURE Act and in other bills) are the following:

- Pooled employer plans, or so-called “open” multiple employer plans (MEPs) – The SECURE Act would create a new type of multiple employer plan called a “pooled employer plan” that would expand the types of employers that can jointly adopt a plan under certain circumstances. The new rule, in essence, provides an override of the commonality of interest requirement historically needed for unrelated employers to offer a combined benefit arrangement by allowing unrelated employers to combine for the sole purpose of providing benefits.

-

Expansion of EPCRS – Earlier this year, the IRS expanded the self-corrections options available under EPCRS (the Employee Plans Compliance Resolution System) for retirement plans. Proposed legislation (although not part of the SECURE Act) would require the IRS to further expand EPCRS to include self correction of “inadvertent” failures and provide that loan failures corrected through EPCRS would also automatically meet the requirements of the Department of Labor’s Voluntary Fiduciary Correction Program (VFCP). The proposed legislation would also expand the types of plans that could be corrected under EPCRS to include IRAs.

-

Student Loans – Again, while not in the SECURE Act, Congress is also considering proposed legislation that would allow employers to make matching contributions to 401(k) plans by treating certain student debt repayments as a 401(k) contribution for this purpose. Although the IRS appeared to provide a path for this type of arrangement in a private letter ruling issued in 2018, that ruling can only be relied upon by the employer that received it and involved a very particular set of facts.

-

Minimum required distributions – The SECURE Act includes a number of MRD related changes, including perhaps most significantly, a limit on so-called “stretch” IRAs by imposing a new rule for defined contribution plans and IRAs that distributions to designated beneficiaries (other than, for example, a surviving spouse and minor children) must be completed within 10 years following death. The SECURE Act would also increase the required beginning date from age 70½ to age 72.

-

Miscellaneous – Other items in the SECURE Act include an expansion of eligibility for elective deferral contributions to individuals who work at least 500 hours a year in 3 consecutive 12-month periods (along with associated nondiscrimination testing and top-heavy relief), an expansion of the 401(k) safe harbor rules, and new portability options and fiduciary protection for lifetime income investments.

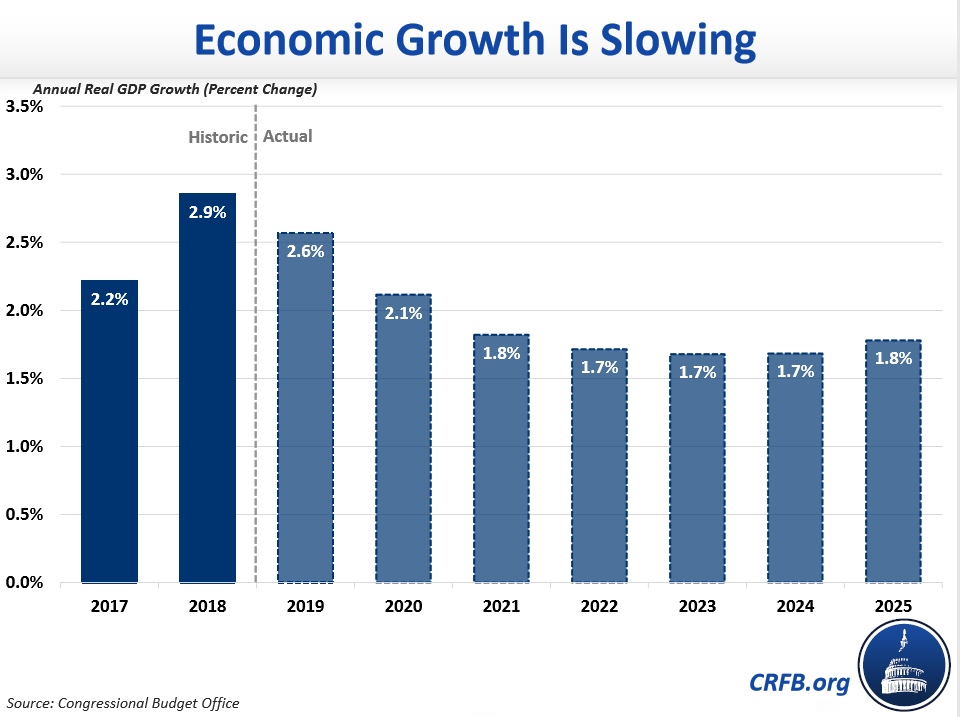

Finally, Marc Goldwein, Senior Vice President and Senior Policy Director for the Committee for a Responsible Federal Budget (CRFB), a non-partisan think-tank in Washington D.C., ended the program with a compelling discussion of current U.S. debt levels and the potential effects of deficit spending on Social Security and Medicare funding.

According to Goldwein, growth in the U.S. has and will continue to slow (even without a recession) to a 1.8% growth trend, down from a 3% or so growth trend in earlier generations. The slow down is driven, in part, by demographics – the U.S. simply does not have enough workers to replace a retiring population. At the same time, deficits and debt are increasing and are expected to exceed $1 Trillion, with approximately one-half of this debt attributable to legislation enacted since 2015. As a consequence, the U.S. should expect to see lower economic growth.

In addition, the various “trust funds” (Highway, PBGC, Medicare and Social Security (Disability and Retirement)) are headed toward depletion. In the case of Social Security, this, explained Goldwein, will impact benefits not just for future generations but, without legislative action, will impact benefits for current retirees as a result of existing benefit cut-back provisions.

You can head to the CRFB website to calculate how the depletion of the Social Security trust fund will impact your own benefit levels.

Goldwein ended his talk with discussions of legislative activity designed to fix Social Security, and noted that whatever the “fix,” the real goal should be certainty so that individuals can plan for retirement.

With a great panel of speakers and engaging Q&A, the Washington Update program again proved that this is a not-to-be-missed event.

Amy Sheridan, Esq. specializes in Employee Benefits in Sullivan & Worcester’s Tax Department in Boston. Amy can be reached at [email protected].